McDonald’s, Starbucks and Apple. Love them or hate them, ask anybody and they will more than likely know what they sell, what their products cost and even when they are open for business.

Some might think those who know everything about their favorite haunts take their loves of labor way too seriously. Vernon Hill II likes it that way. “There are three kinds of brands,” says Hill, former chairman, president and CEO of Commerce Bank. “The first is you know the name, but you are not attached to it. The second is if you mention the name, you feel good about it. The third is an emotional attachment to the brand. When you become part of it, you want others to be a part of it.”

Every business, large and small, can achieve bond-with-their-brand adoration, says Hill. His first book, “Fans! Not Customers: How to Create Growth Companies in a No Growth World,” dissects Hill’s formula for customer service, one that has guided him since Commerce opened its first storefront in Marlton in 1973. By the time he left the company in 2007, there were 400-plus locations in eight states and Washington, D.C. Commerce, as well as his newer projects, showcases Hill’s philosophy throughout the 156 pages.

“The book talks about my experience in building brands and how to get it done,” says Hill, 67. “This is new, and it talks about Metro Bank in London. It also talks about Petplan.”

“The book talks about my experience in building brands and how to get it done,” says Hill, 67. “This is new, and it talks about Metro Bank in London. It also talks about Petplan.”

Hill completed a manuscript in 2007. He departed Commerce in June of that year, and the book never made it to print.

TD Bank begs to differ. They claim that the November release is not an entirely new work. In a civil complaint filed in United States District Court, District of New Jersey, the bank that merged with Commerce months after Hill’s departure is claiming copyright infringement, and that the 2012 book has caused “irreparable harm to TD Bank.” TD says it owns the book from the time it purchased Commerce and that chunks of the 2012 work are reproduced verbatim from the one years ago. It is asking the court to impound all of the copies and award it damages and any resulting profits.

“The idea that copyright law can be used to prevent Mr. Hill from telling his own story is ludicrous,” says Hill’s attorney, Howard Hogan. “The book that Mr. Hill has published is a book about Metro Bank and Mr. Hill’s business philosophies – ideas that he has been expressing publicly for decades. TD Bank does not and cannot own ideas.”

“It’s giving the same ideas to others to build brands in a no-growth world,” says Hill. “If we can do that in banking, then any business can do it. It’s sharing my experiences and sharing my story.”

Part of that story is the high-profile venture Metro Bank. Hill co-founded the business in 2010 and applied the same aspects that made Commerce’s name, such as pet-friendly practices, longer opening hours and free coin counting. It is the first High Street bank, a nickname for the United Kingdom retail-banking sector, to open in 100 years.

“A friend of mine wanted me to take the banking model to Britain. When I left Commerce, he saw I had no excuse,” says Hill, a Moorestown resident. “Everything that works in America works better in Britain. It has everything to do with great service. The customers have responded overwhelmingly to us.”

Metro started with four locations, grew to 13 throughout the London area and had three more set to open by the end of 2012, adds Hill. “In the long run, the plan is to have 200 in the Greater London market,” he says.

Hill also has interests beyond banking. He is a partner in US Restaurants Inc., which operates 40 Burger Kings in Philadelphia. He is also still involved with Site Development Inc., a real estate development firm that has created more than 1,000 shopping and retail centers. One of his latest ventures, the pet insurance company Petplan USA, also appears in the book. It has ties to Britain, as well, but found its way here via the University of Pennsylvania.

Founders Chris and Natasha Ashton came across the pond to study at Hill’s alma mater, Penn’s Wharton School. When their cat became ill, the Ashtons found themselves with a $5,000 veterinary bill. It was a light-bulb moment for them. They realized they could bring England’s hugely successful model of pet insurance to the United States. Hill became an investor five years after the 2003 launch.

“I’m involved in the School of Veterinary Medicine at Penn. I met them through it,” says Hill. “It took time to make it happen. Eventually, it was the right time. The business was in the growth stage.”

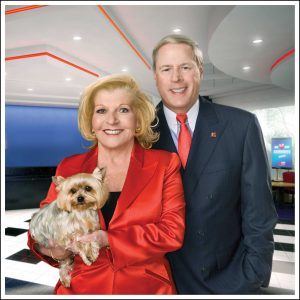

Vernon Hill with his wife Shirley and their dog Duffy

Soon after Hill was named chairman of the board in 2008, service hours were extended, being an animal lover was required to work the call center and the pet health magazine “fetch!” was launched to strengthen customer relations. When 2011 rolled around, Petplan became the first pet insurance provider named to Inc. Magazine’s 500 fastest-growing companies in the country.

“Petplan fit my business model of presenting something different, a culture that reinforces the model and being fanatical about the execution of the model,” he says.

The philosophy that Hill subscribes to – that customer service can be the decisive factor in success – fit easily in a company far removed from banking. It reinforced his belief that anyone can apply his thinking to achieve the result they want.

“I hope readers get thinking that they can create the American dream,” says Hill. “It doesn’t matter what the business is. If it’s a bank or a growing business, there is no business that can’t do it.”